How we doing boys and girls? Has everyone recovered from the Gamestop collapse? Like I mentioned in my last post, my thoughts and prayers are with all of you never-sellers. And good news for you – you can jump back in now. The $10 stock is on sale for the measly price of $250 if you’re interested! All you have to do is buy and HOLD HOLD HOLD!

Does anyone else get blood-red-mad just looking at that idiot?

If I could do my life over again – I’d study the fundamentals of finance from a young age and grow up to become some bigshot at the SEC or IRS just so I could put a HARD freeze on every stock that guy owns. I’m talking about an un-thaw-able freeze.

“Here you go fuckhead I got you locked in for life on your current positions. I have implemented irreversible restrictions on the selling of each and every one of your stocks. Enjoy your diamond hands.” -me the SEC guy

More importantly – who are the other 246,075 viewers who clicked on that video and watched it unironically? I can not stress this enough: I am positive I could tell you whatever he is going to spend 23 minutes talking about and I could do it in less than 60 seconds.

The difference between that youtube guy and me is he puts on a collared shirt and a silver chain link watch and I’m currently wearing one of those Bill Belicheat short sleeve hoodies and I can’t remember where I last set my fitbit down.

One last thing on that guy. The 3 stocks he gave out in that video were Amazon, Apple, and Google. I shit you not, that’s what he needed 23 minutes of your time to tell you. Fucking Amazon. The three stocks that my dog could pick out if I gave her 23 minutes to do it. “WOOF I LIKE THESE ONES WITH THE BIGGER NUMBERS WOOF.”

Ok I’m good now. Got that out of my system. All I did was google the words “never sell” and that poor bastard just happened to get caught up in my wrath. So what are we here to discuss today?

Let’s start with a recap. But before we do…let me check in with a buddy of mine real quick…”Hey Greggers, it’s been a few weeks since we last looked at the portfolio….how are we doing?”

QUITE STRONG IT IS. HELL YEAH!

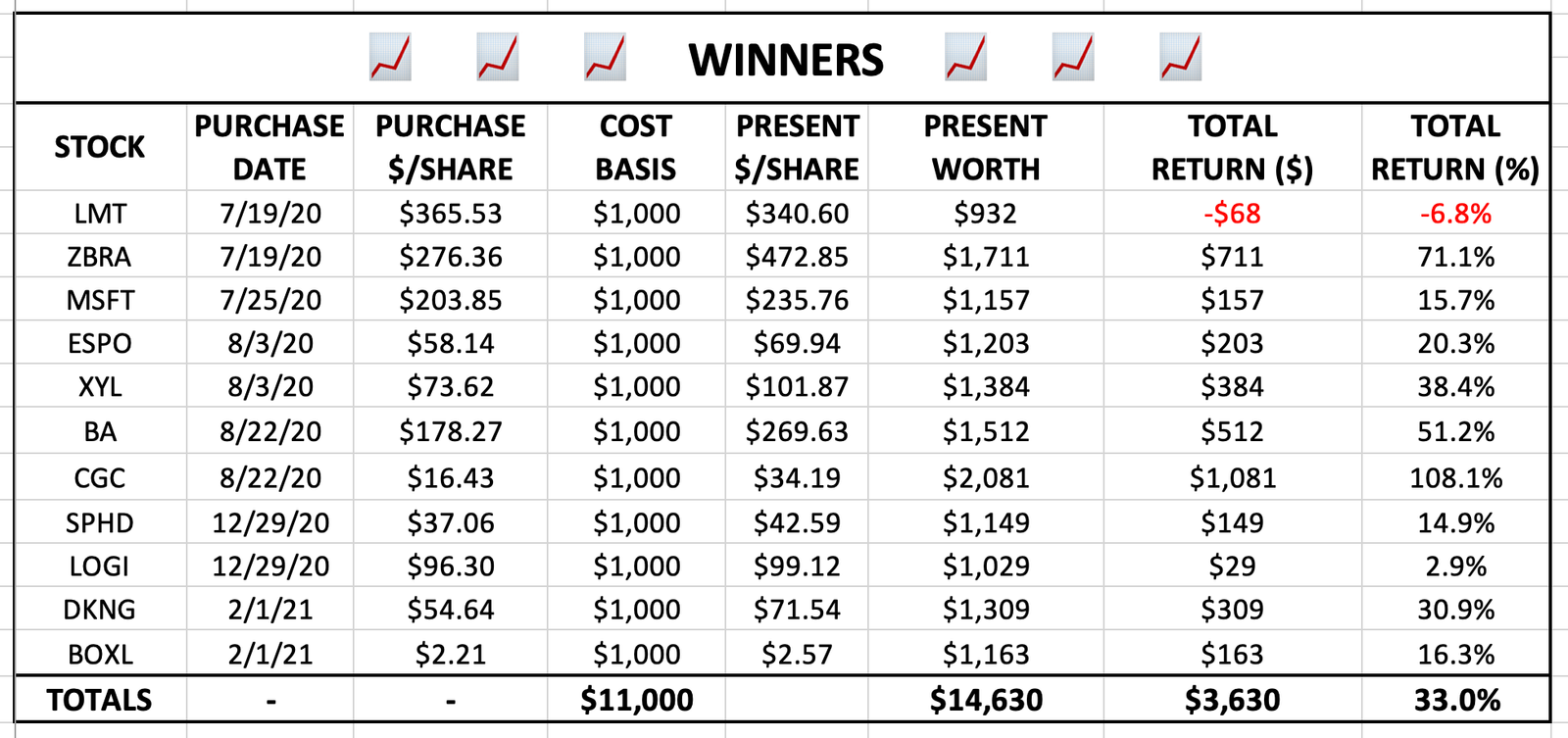

We’ll continue to work under the assumption that you have purchased $1,000 worth of every stock I recommended (because why wouldn’t you?). Here’s where we stand:

All right we may not be doing snow angels in wads of bills…but 33% in 8 months time ain’t too shabby. One of the classic lines your scumbag financial advisor probably loves to tell you is “Looks like we outperformed the market this quarter!” Well for reference, the market is up 23% over that same timeframe. I’m beating that by 10 points. So SUCK ON THAT (ten times) MR. DOW JONES.

Also – remember how I mentioned earlier that the difference between that YouTube guy and me was his collared shirt? On a similar note, the difference between you and your financial advisor is a necktie and about 4 hours of online research. You’re going to give that guy a percent of your returns because his college degree says “FINANCE” on it??

If you are under the age of 30 and don’t have kids, stop being a pussy and cut that guy out of your profits (please don’t – this blog is not meant to be taken seriously). Max out your Roth IRA every year (70% US Stocks, 20% Int Stocks, 10% Bonds) and contribute as much as your employer will match on your 401k. This isn’t rocket science.

At the end of the day I still like every single one of those sumbitches I recommended. I’d double down on all of them in a heartbeat. In fact, I’m ORDERING you to double down on $LMT and I’m doing it for 2 reasons:

- There is no better feeling than doubling down on a stock to lower your average cost/share.

- The administration change. Playing the presidency stock game is all about anticipating whose hands will get greased by our corrupt president. I’ve done zero research on this, but I’m pretty sure Joe Biden orders airstrikes for fun while he’s watching his Sunday morning cartoons. Can you say aerospace defense?

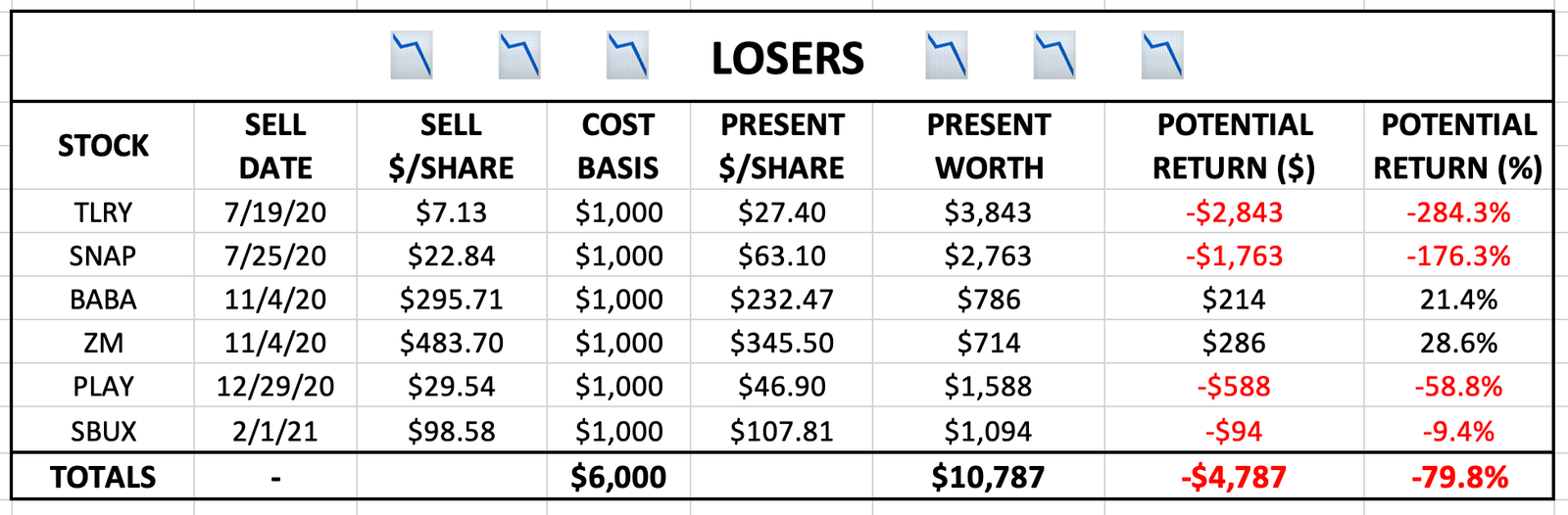

Ok enough is enough. Let’s take a look at the other side of things. Here are how the stocks I told you to sell (LOSERS) have been doing since you cut ties with them:

Ok so maybe I cost you a potential 80% gain by advising you to sell a little Tilray and Snapchat. Big whoop. What do you want from me? Everything I touch is a winner. Clearly I suck at identifying shitty stocks. Though I standby my position on that cancerous Snapchat app. That thing will go to zero eventually. “I may be early, but I’m not wrong.” – Big Short guy

But can I get some credit on Alibaba? I told you the company website looked like it was a high school ebay experiment and within 2 months the founder straight up vanished.

Has anybody figured out how to factor “the CEO may get kidnapped at any moment” into their price point on BABA? I think that’s worth slashing about $100 off the price.

No need to dwell on my selling failures any longer. Let this be a lesson learned. If I tell you to buy it – then you buy it. If I tell you to sell it – then you buy it twice as hard (unless the company is so shitty that the CEO is subject to faking his own death).

So since I am painfully bad at identifying terrible stocks, I will stick to Winners today. Who wants more money?

WINNER: MJ

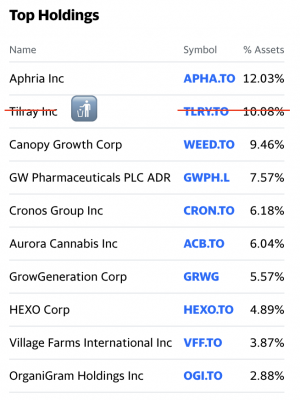

How many times have we talked about exchange traded funds at this point? Too many I’m sure. So I don’t need to talk to you guys like children anymore. Lower risk = lower reward.

Snagging a chunk of $MJ will give you a little more skin in the game within the cannabis sector. Despite the recent volatility and all of the uncertainties of marijuana, I am still long on this stuff. I don’t even think it’s all that risky. When all is said and done, recreational marijuana will be legal at the US federal level and when that time comes, you will have a nice bump and potential escape hatch if you want to use it.

Personally, I will be holding long after it’s legalized. I can already picture the 500-foot line of idiots standing out in the cold waiting for their turn to buy a $30/gram of weed. “I need it for the severe arthritis I developed while holding a pencil in school for all those years.”

Essentially MJ has stake in every major player involved. In theory, a few of these companies could make it big and then a majority of these guys will fight over the scraps. And yes, by buying this fund we are showing additional faith in Canopy Growth Corp.

Please disregard that absolute TRASH in the 2nd row. It’s unfortunate that Tilray sneaks into this ETF, but having 10% dogshit inside your ham sandwich is a small price to pay for when this sandwich turns into one of those gigantic Pittsburgh sandwiches with the fries jammed inside.

WINNER: SPY

Can you tell I’m playing it safe in this installment? But why not brotha? We already have plenty of action in individual stocks. So grab some ETFs.

To compare this to sports gambling – I am basically telling you that you have a whole bunch of +200 and +500 longshots in play, and now I want you to add a few -150s and -200s to your card.

I don’t know why people assume Robinhood traders will leave the market anytime soon. You think Joey Sbarro is just gonna go back to losing $50 a week betting on the Pats now that’s he’s gotten a uncut taste of 10xing his $1,000 punt on NKLA? He’s in until he loses it all.

— Quantian (@quantian1) July 8, 2020

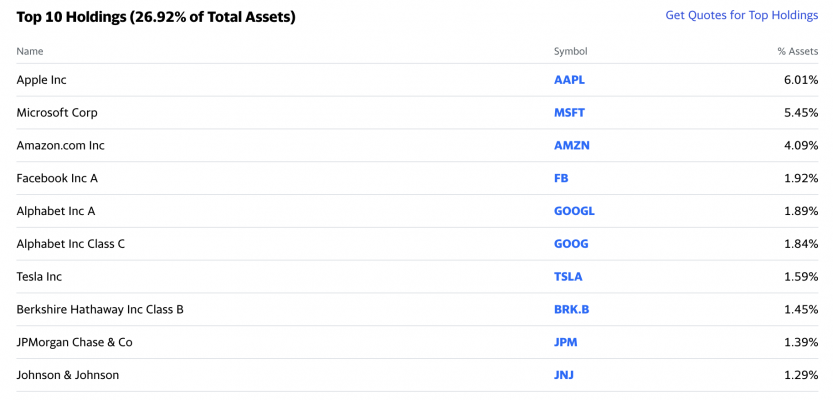

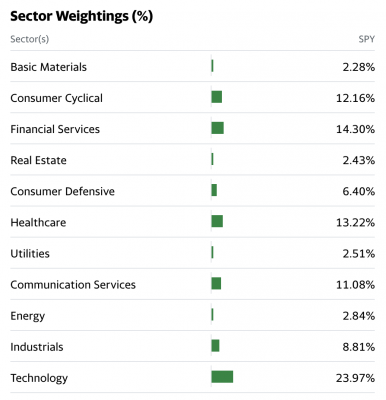

So what is this thing? $SPY is basically the stock that your idiot financial advisor brags about out-performing. It simply tracks the market in general. More specifically it tracks the Standard and Poor’s 500 Index. All I really care to know about the S&P 500 is that it takes roughly 500 gold-standard companies and slaps them into one index. Good on you if you care to delve into the specifics on something that’s comprised of 500+ companies. Here’s what Yahoo says is in that black box:

According to my sources, which I am too lazy to cite, $SPY is the 1st (or possibly 2nd) most heavily traded ETF in the US. Furthermore it was the 1st ever fund of it’s kind to track the S&P 500. So basically these guys are pioneers. The modern day William Clark’s of the US stock market.

So that’s pretty much it. Since we are playing it safe this week feel free to go ahead and throw a few hundred on something risky. Hell, nobody says you have to stick to the stock market either. Throw $100 on Prairie View A&M to bring home the March Madness hardware.

Snake’s Stock Corner Disclaimer: I don’t have a GD clue what I’m talking about and if you are considering using any of the above information in your real-life investment strategies then you should seek help at 1-800-GAMBLER.