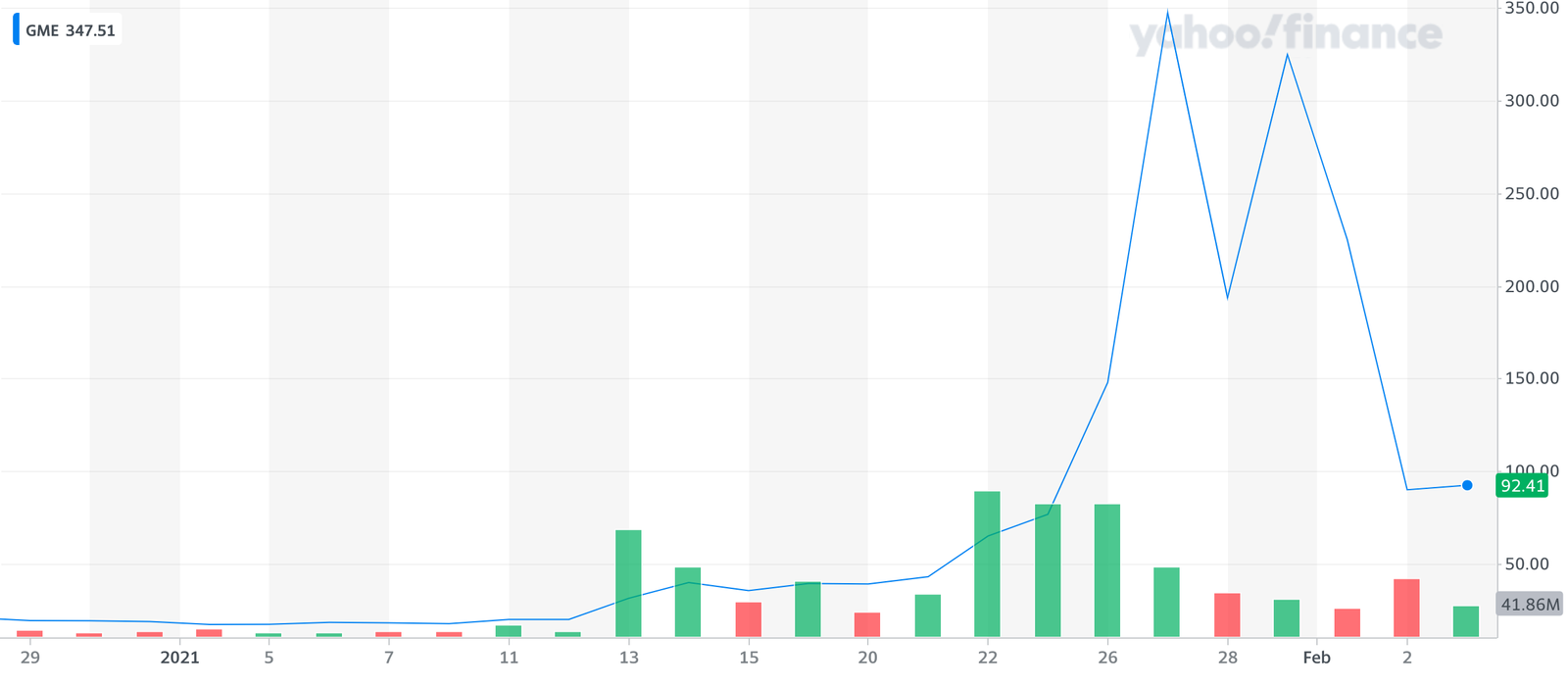

In other news, GameStop finished the day down exactly 60% pic.twitter.com/GCtPeNGIlC

— Morning Brew ☕️ (@MorningBrew) February 2, 2021

Second day in a row GME isn't in the top 5 most active

— Helene Meisler (@hmeisler) February 3, 2021

If you have a pulse and you are literate, then all you have heard about the past few weeks is GameStop’s stock price. GameStop this, GameStop that, WallStreetBets, short squeeze, Robinhood, hedge funds, etc.

In general, humans aren’t meant to process vast amounts of worldwide information and constant news media coverage. I’m no expert, but I have read the first 50 pages of Sapiens about 4 times now (before taking a break from reading and then forgetting what I read and then repeating the process 6 months later). But my understanding is that our ancestors used to walk through the forest on their tippy toes picking up berries and trying to hunt squirrels with what I would refer to as a marshmallow roasting stick. If somebody’s own mother died they probably didn’t find out about it until 5 days after the fact.

Flash forward to today and every major news network has a scrolling red ticker with capitalized letters across the bottom of the screen trying to illicit panic. That’s a real issue. I don’t like to get serious on here, but I don’t think it’s farfetched to assume that the media will play a huge role in the extinction of the human race.

(And yes, I actually believe that. I’m not joking. Try walking up to a Biden supporter and say “I’m rooting for Joe, but I thought Trump did a nice job” and see what happens)

So as all of this GameStop stuff unfolded throughout the last week, I did my best to follow the news. I would check in to see where things stood several times a day. I went through a variety of emotions and hot takes and flip-flopped in my own head many times during this journey. And now as this retail pump-and-dump saga seems to be nearing the closing bell, I have had some time to reflect on it. Here are my thoughts:

I WANT JUSTICE FOR THE GAMESTOP INVESTORS

Oh shit I think I phrased that incorrectly. Maybe I left out a word.

*I WANT THE GAMESTOP INVESTORS TO BE BROUGHT TO JUSTICE*

That’s right. I want the names of anyone and everyone who bought GameStop stock over $100/share. I want to gather those people up, pack them all into one courtroom, and then have a judge read out the following:

“I, Joe Smith, judge of common sense and basic human decency, hereby find you all guilty of greed and irresponsibility and sentence you to a lifetime of Snake’s Financial Rules of Reckoning. For those of you who are unaware of the terms included in Snake’s Financial Rules of Reckoning, I will now list the punishments:

- Forfeiture of all future stimulus check payments created by the Federal Reserve

- Forfeiture of all future unemployment compensation, medicaid, medicare, social security, etc.

- Lifetime ban from trading stocks

- (You can trade funds that are comprised of bonds only. This way you can watch your money accumulate interest at a painfully slow rate.)

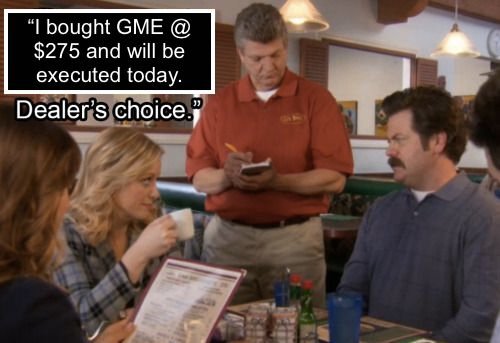

- Any person caught contributing to publications that describe your personal story of how “Danny Dumbass was up big, but lost it all” with a picture of you standing in front of your house with a FOR SALE sign will be subject to a public execution at Wall St, New York, NY, 10005. The method of execution will be at the discretion of Snake aka dealers choice.

Obviously I’m joking about the execution part, but I swear to god I think it should at least be brought up at the round table. Losing more than you can afford to lose on a meme stock is an unforgivable offense. To be clear – I think you should be entitled to gamble with your money and lose it. But if you are doing it at an irresponsible level then I 100% hate you. Two reasons: A) You are going to ruin this shit for the rest of us, and B) we are in debt.

The US debt is currently at $27 trillion. Divide that up per head and each and every one of us is on the hook for $84,000.

Look, I’ll pay off my $84k, but I ain’t paying a penny more than that. I didn’t ask you to drop $200k on a degree that says “General Studies.” And I sure as shit didn’t ask you to withdraw your 401k or sign up for a new credit card so you could YOLO your net worth on a shitty stock for internet clout. You did that to yourself.

If you got in GME @ $275 and got out @ $100 – that’s on you. You take your 64% percent loss and go get a second job at restaurant within walking distance. I don’t want to see you ‘refi your interest rate.’ Suck it up and pay the entire thing back at your obscene interest rate. Take your goddam medicine.

I bought at the absolute high on $amc $nok and $nakd and sold at the exact bottom. I lost 700k and people are calling me a suit and a pussy. I may be a pussy but I’m def not a suit

— Dave Portnoy (@stoolpresidente) February 2, 2021

And spare me the excuses. I don’t want to hear sour grapes about how the big guys manipulated the market when you tried to tried to contribute to manipulating the market. In fact, I don’t wanna hear any of the following:

“BUT THE HEDGE FUNDS CHEATED!”

Are you brand new to this shit? Just FYI Hedge funds make money 100% of the time. You and your 70 shares of GME are not going to bring an end to Wall Street corruption. I’m sorry that you must have learned what the stock market is 10 seconds before you bought your shares and bought into that ideology that you could change the system.

“BUT ROBINHOOD RESTRICTED MY ABILITY TO BUY MORE SHARES!”

Again you must be new to this stuff. It’s Robinhood. Anyone that has ever used it before knows that once a week the app is going to crash. It’s fucking free. What did you think Robinhood owed you for the 0 dollars and 0 cents you gave it? I understand that the CEOs explanation as to why he did that seems totally misleading. But believe it or not, the CEO of the most popular broker service probably isn’t allowed to come out and say “we were scared we wouldn’t have enough money on hand to meet our clearing limits.”

Also as far as I’m concerned, all of you idiots owe that Vlad guy a gigantic ‘Thank You’ because you know damn well you would have been buying more shares above $400.

*Full disclosure: I was pissed about this one too at first and I didn’t even have skin in the game. I honestly contemplated moving my money to a different trading app. But upon further review…cooler heads prevailed.*

“RESTRICTING OUR ABILITY TO BUY SHARES CAUSED THE CRASH!”

I’m sure it didn’t help, but you know what else caused the crash? The fact that the stock was artificially valued about 1000% higher than it actually is.

And go ahead and google “stock halt” one time. These things exist for a reason. I can only imagine how pissed all of you would have been if Wall Street cancelled your ability to sell the stock during a full blown halt. Just be glad Robinhood gave you the chance to cash out at the peak.

Looks like Robinhood just stopped supporting GameStop, AMC, Blackberry, and Nokia. Users can close out positions but can’t buy more pic.twitter.com/ZOE8NJuVum

— Josh Billinson (@jbillinson) January 28, 2021

Aside from those copy and paste outrage claims above, here are some of the other idiotic things I saw throughout the week:

Robinhood legitimately hid $NOK $AMC $GME and $NAKD from search. Internet psychology 101, this will only make things worse for you Wall Street. Things are getting blown the fuck up today. Take all the cash you can afford to lose and buy buy buy.

— FaZe Banks (@Banks) January 28, 2021

Not sure who FaZe Banks is but that person should do prison time. At least he was unintentionally correct when he said “Things are getting blown the fuck up today.” He also was kind enough to give you notice that you should be prepared to lose it all. Good foresight on that one as well, FaZE.

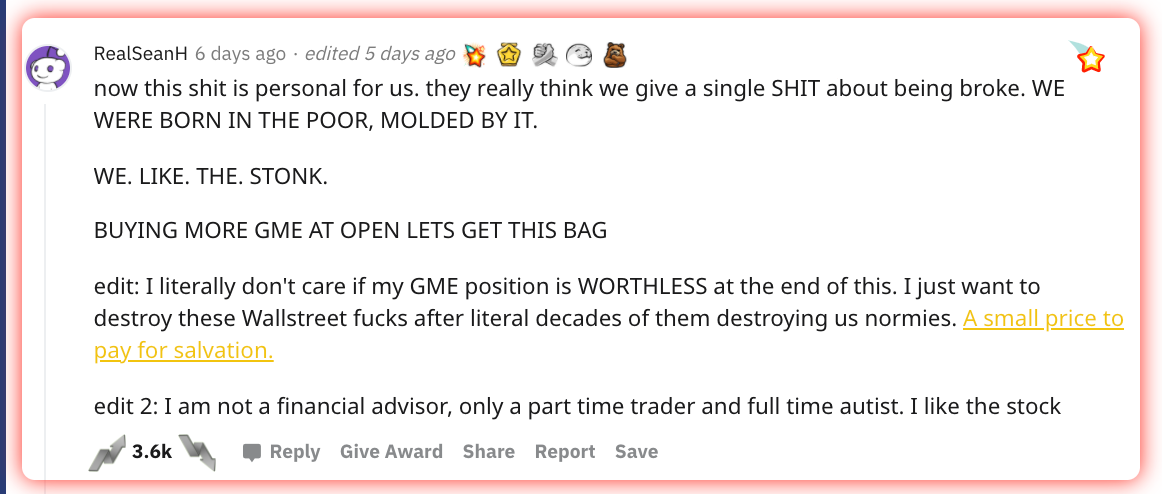

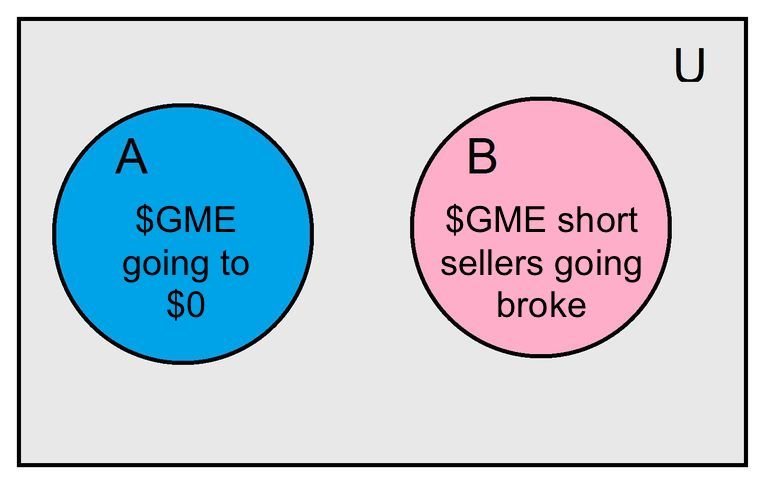

Rule #1 of trading: Always make buying shares of companies personal. Also if you care about living in poverty then don’t bother with this STONK. Lastly, I wonder how he thinks his position could be worthless while he also “destroys these Wallstreet fucks.” Those two things are mutually exclusive.

This is the sort of shit I’m talking about. This is the guy that will end up with $50,000 in credit card debt and you and me will ultimately be responsible for inheriting that debt through inflation.

Imagine getting in at $447? I just looked at the Yahoo chart on a minute-by-minute breakdown and I could only identify 2 minutes in real time where the stock was at $447 or above since this stock became public in 2002. THAT’S 2 MINUTES IN THE LAST 20 YEARS!!! That’s like hitting the lottery of stupidity.

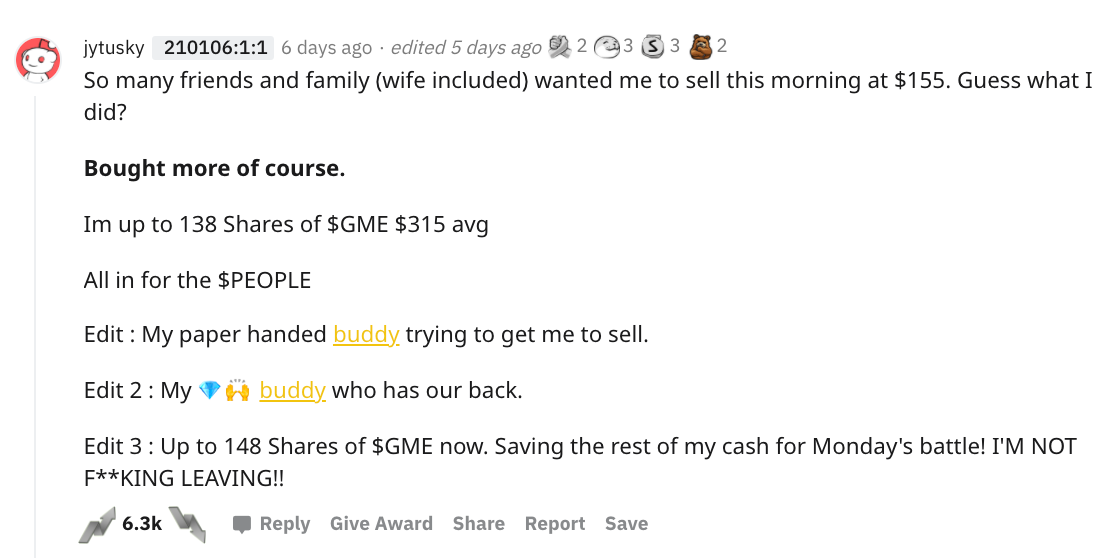

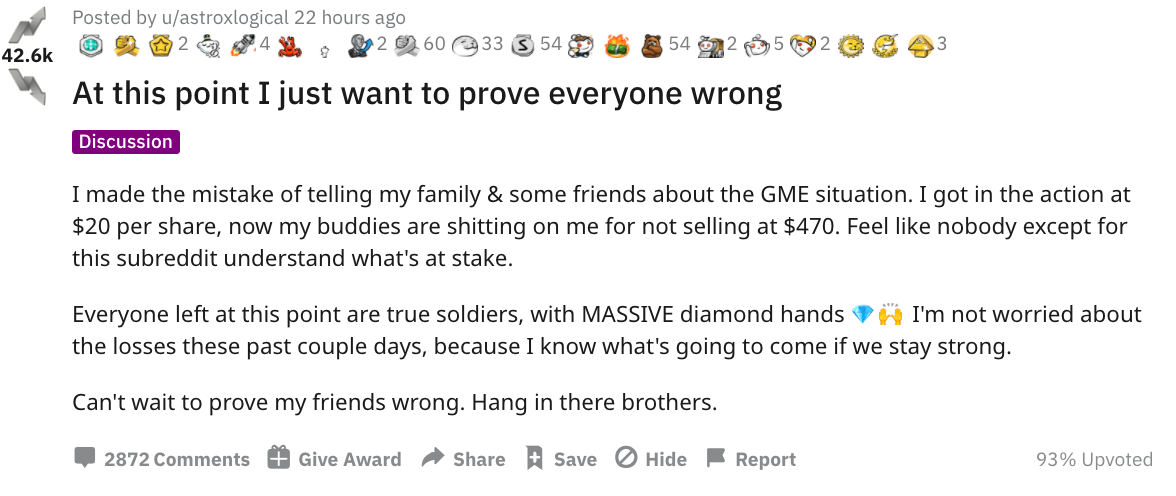

This is far and away the most consistently stupid take I saw all week. The amount of people turning on caps lock and typing “NEVER SELL!” is astounding.

The act of ‘never selling’ is nonsensical for so many reasons, but let’s start with the obvious: If you never sell a stock then you have a 100% chance of profiting $0.00. That’s the most basic principle of all time.

I realize these idiots are trying to imply that if virtually nobody sells the stock it will continue to skyrocket. But the problem with this idea is the freeloader theory exists and it exists in full force in the stock market. It only takes a few smart people (freeloaders) to lock in their gains and create the arms race. This is exactly why there is no toilet paper at your grocery store right now.

Also, I’ve given it some thought and tried to come up with the best real-life comparison to the ‘never sell’ reddit theory. Here it is:

You and a couple friends are all hanging out watching football and you decide to order a pizza. After the pizza arrives, one of your friends decides that no one should eat the pizza in order to preserve all of the pizza slices. One of your other friends stands up wide-eyed and announces: “If nobody ever eats the pizza, we will have unlimited pizza forever!”

I realize there is a lot of sarcasm on this subreddit. These guys all seem to call each other “retarded” and “autistic” in the form of compliments.

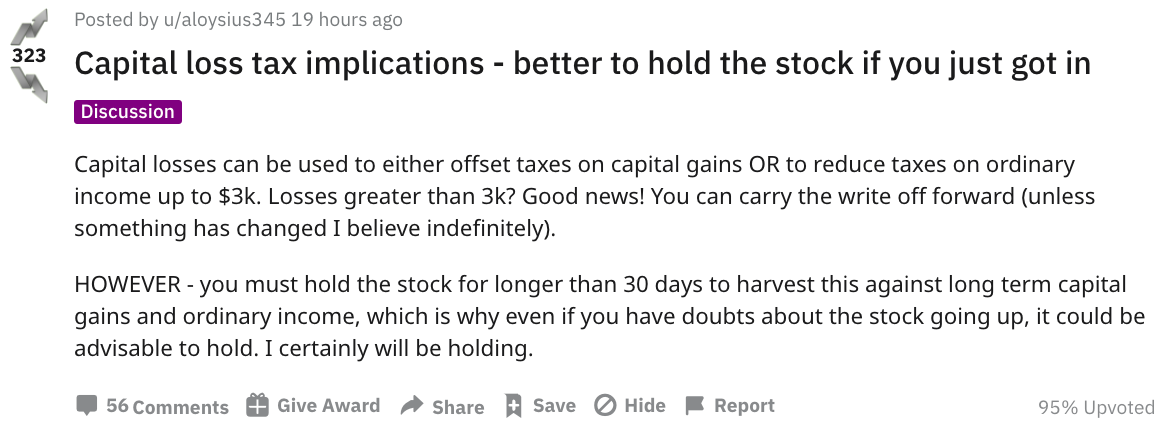

With that being said, I think this guy is legitimately being serious. He thinks taking a tax write-off for a loss will be cheaper than losing the money of the loss itself. Which makes a lot of sense if you’re in one of those tax brackets that taxes you at a rate of more than 100% of your income!

I feel sorry for this guy and his MASSIVE diamond hands. Another instance of getting emotionally invested into a company that sells physical video game disks in 2021.

Sometimes you just have to take a big step back and realize that you have invested your monthly car insurance payment into a company whose headquarters looks like an abandoned shed. (That example is me when I got too deep into a cannabis penny stock)

In conclusion, please abide by FaZe Banks’ advice and DO NOT invest more money than you can afford to lose. And that rule doesn’t just apply to GameStop. It applies to everything ever. Even if you are positive that the Weeknd’s opening song at the Super Bowl will be ‘The Hills’ and your bookie is giving you +1000 odds on it.

Gamestonk!! https://t.co/RZtkDzAewJ

— Elon Musk (@elonmusk) January 26, 2021