Every July 1st I find myself stumbling across multiple “Happy Bobby Bonilla Day” tweets and headlines on the major sports network websites. If you are unfamiliar with this, the New York Mets owed a washed up Bobby Bonilla $5.9 million dollars in 2000. So instead of buying him out, they offered him an alternative deal of $1,193,248.20 annually (every July 1st specifically) from 2011 until 2035.

The Mets front office gurus at the time had money tied up with an investing wizard named Bernie Madoff (not making this up) and were returning between 12-15% annually on investments. By saving the $6 mill, the Mets felt that they could save this lump sum of cash to use on prized free agents to make a World Series run (which they ultimately did). Madoff (Dead or Alive?) was of course cooking the books so although a golden idea in theory, this surely did not work out how they anticipated.

Once asked about the deal, Bonilla was quoted as saying “Good things come to those who wait.” But the question I’ve asked myself multiple times: Was this truly a genius move by Bonilla to wait?

Common sense tells us why would I accept $5.9 million now when I can have $25 million later, but common sense also tells us 1 million dollars worth in 2000 isn’t 1 million dollars worth in 2035. Similar to the idea that $10K in 1965 buys me the nicest car on the road and $10K in 2000 buys me three textbooks for college.

So what if Bonilla would have taken the $5.9 million in 2000 and continued to invest all earnings in the stock market until 2035? Could he possibly have made just as much?

The average annual return in the S&P 500 is 10% minus 2-3% for inflation so let’s assume an 8% return annually, which is a pretty commonly used figure. This is of course also assuming that Bonilla deferred this contract for the sole purpose of investing the money, and not a penny of it was to be spent on a new ride, new pad, or hookers.

I started crunching some numbers to figure this out myself. Like my one buddy’s game on a Friday night, I would say it didn’t go great. Despite taking Business Math 110 Business in college, I would be lying if I said I had a single business whiz gene in my body. Obviously, a basic compound interest formula can help you calculate how much money Bonilla would have grossed if he took the $5.9 mill up front and invested for 35 years. And another not-so-basic compound interest formula with annual contributions can help you calculate how much he would have made with $1.19 million investments for 25 years.

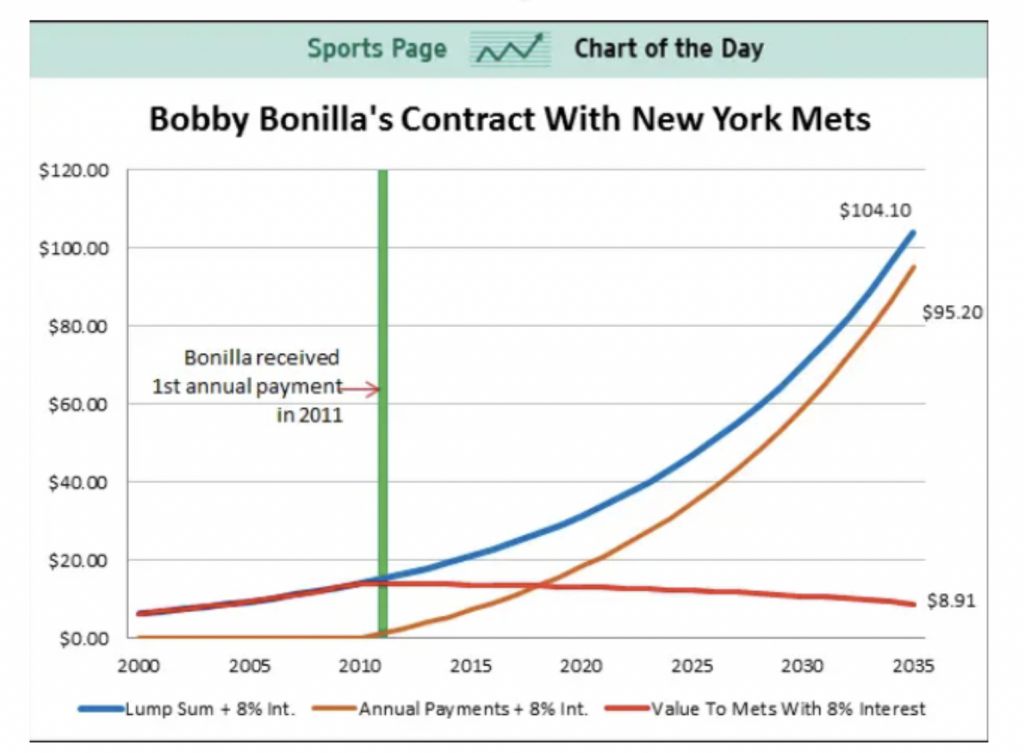

So, I crunched the numbers on this multiple times and kept getting around roughly $85-90 million for both scenarios meaning maybe this wasn’t the worst idea ever by the Mets. But what these formulas can’t account for however is inflation rates over the course of so many years and other factors that I wouldn’t even want to dive into. Luckily, someone did want to dive into it though.

Turns out some guy from Business Insider named Cork Gaines actually has no life also and decided to crunch the numbers on this as well.

What he calculated is pretty wild…

If you don’t know how to read a graph, the orange line represents the deal that Bonilla took and the blue line represents the deal that Bonilla turned down. (For those that are color blind, that’s the bottom and top ascending gray lines, respectively.)

Amazingly, if this Cork guy isn’t getting his jollies off just to mess with all of us, Bonilla did not make out on this deal at all. In fact, he LOST OUT on $9 million dollars by not taking the lump sum up front and immediately investing. Wow. You can see Cork’s work here.

Let’s just say I would consider myself someone who is always looking for a reason to drink. So join me July 1st every year until 2035 in pouring one out for Bobby Bonilla and wishing everyone a Sad Bobby Bonilla Day.